Decoding FIRE: A Comprehensive Guide to Financial Independence, Retire Early

FIRE, the acronym for Financial Independence, Retire Early, represents a lifestyle goal coveted by many seeking freedom from the traditional 9-to-5 grind. It’s more than just retiring young; it’s about crafting a life where work is optional, fueled by passive income and strategic financial planning. This comprehensive guide delves into the various FIRE strategies, providing a roadmap to navigate the complexities and achieve your own version of financial freedom.

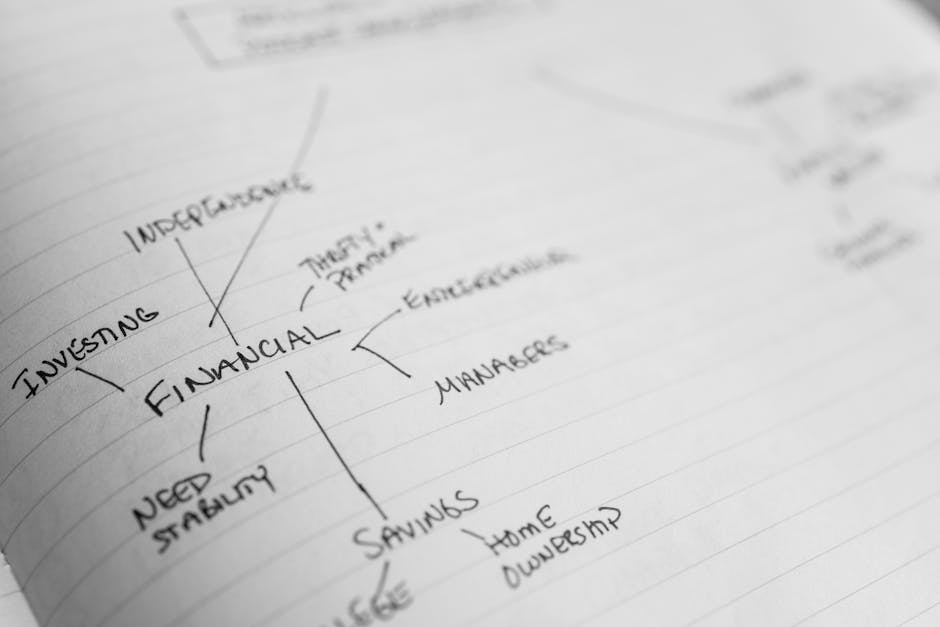

Understanding the FIRE Spectrum: Finding Your Path

FIRE isn’t a one-size-fits-all solution. The “Early Retirement” aspect is subjective, varying based on individual lifestyle aspirations and financial realities. Recognizing the different FIRE subtypes allows you to tailor your approach for optimal success.

-

Lean FIRE: This approach prioritizes aggressive saving and extreme frugality. Individuals aiming for Lean FIRE typically live on a minimal budget, often less than $40,000 per year. This necessitates a lower investment target but requires significant lifestyle adjustments. Expect significant downsizing, meticulous budgeting, and a willingness to forego many common comforts.

-

Fat FIRE: The opposite of Lean FIRE, Fat FIRE envisions a comfortable retirement with a lavish lifestyle. This requires a significantly larger nest egg to support higher spending. Individuals pursuing Fat FIRE might aim for a retirement income exceeding $100,000 per year, allowing them to maintain their current standard of living or even upgrade it.

-

Barista FIRE: This hybrid approach involves retiring from a high-pressure, demanding career and transitioning to a lower-stress, part-time job that provides health insurance and supplemental income. It allows for some financial flexibility while maintaining a sense of purpose and social connection. Think of working part-time at a coffee shop (hence the name) or pursuing a passion project that generates modest revenue.

-

Coast FIRE: Coast FIRE is achieved when your existing investments are projected to grow sufficiently to cover your retirement needs by a specific age, without requiring further contributions. You can then “coast” along, focusing on career fulfillment rather than aggressive saving. This often involves working a less demanding job or pursuing entrepreneurial ventures with lower financial risk.

Calculating Your FIRE Number: The Cornerstone of Planning

The FIRE number, the amount of money needed to retire comfortably, is the foundation of your financial independence journey. This calculation is based on your estimated annual expenses and the 4% rule, a widely accepted guideline.

-

The 4% Rule: This rule suggests that you can safely withdraw 4% of your retirement savings each year without running out of money. This percentage is based on historical market data and inflation rates.

-

Expense Tracking: Accurately tracking your expenses is crucial for determining your annual spending. Utilize budgeting apps, spreadsheets, or personal finance software to monitor where your money goes. Differentiate between essential expenses (housing, food, transportation) and discretionary expenses (entertainment, travel, dining out).

-

Calculating Your FIRE Number: Once you have a clear understanding of your annual expenses, multiply that number by 25. This represents the amount of money you need to accumulate to generate that income stream using the 4% rule. For example, if your annual expenses are $50,000, your FIRE number would be $1,250,000.

-

Adjusting for Inflation: Remember to factor in inflation when projecting future expenses. Use an estimated inflation rate (historically around 3%) to adjust your FIRE number accordingly. Online calculators can help you perform these calculations and account for inflation.

Strategies for Accelerating Savings and Investments

Achieving FIRE requires a disciplined approach to saving and investing. Maximize your savings rate and invest strategically to grow your wealth exponentially.

-

Increase Your Income: Explore opportunities to boost your income through side hustles, freelancing, promotions, or career changes. Negotiating a higher salary or acquiring new skills can significantly accelerate your progress.

-

Reduce Expenses: Identify areas where you can cut back on spending without compromising your quality of life. Consider downsizing your home, refinancing debt, negotiating lower utility bills, or adopting a more frugal lifestyle.

-

Automate Savings and Investments: Set up automatic transfers from your checking account to your savings and investment accounts. This ensures consistent contributions and removes the temptation to spend the money.

-

Optimize Investment Portfolio: Diversify your investments across various asset classes, including stocks, bonds, and real estate. Consider investing in low-cost index funds or ETFs to minimize fees and maximize returns. Rebalance your portfolio regularly to maintain your desired asset allocation.

-

Take Advantage of Tax-Advantaged Accounts: Maximize contributions to 401(k)s, IRAs, and other tax-advantaged retirement accounts. These accounts offer tax benefits that can significantly boost your long-term savings.

Building Passive Income Streams: The Key to Sustainable FIRE

Passive income is income that requires minimal ongoing effort to generate. Building multiple passive income streams is essential for achieving a sustainable FIRE lifestyle.

-

Rental Properties: Investing in rental properties can provide a steady stream of passive income. However, it also requires significant upfront investment and ongoing management. Consider hiring a property manager to handle day-to-day tasks.

-

Dividend Stocks: Investing in dividend-paying stocks can generate passive income from dividend payments. Choose companies with a history of consistent dividend payouts and strong financial performance.

-

Online Businesses: Creating and monetizing online content, such as blogs, websites, or online courses, can generate passive income through advertising, affiliate marketing, or product sales.

-

Peer-to-Peer Lending: Lending money to individuals or businesses through peer-to-peer lending platforms can generate passive income from interest payments. However, it also carries the risk of default.

-

Royalties: Creating and selling intellectual property, such as books, music, or software, can generate passive income from royalties.

Navigating Potential Challenges and Risks

The path to FIRE isn’t without its challenges. Be prepared to address potential risks and adapt your strategy as needed.

-

Market Volatility: Market downturns can significantly impact your investment portfolio. Diversification and a long-term investment horizon are crucial for mitigating this risk.

-

Inflation: Unexpectedly high inflation can erode the purchasing power of your savings. Adjust your FIRE number and investment strategy accordingly.

-

Unexpected Expenses: Life throws curveballs. Be prepared for unexpected expenses, such as medical bills or home repairs, by maintaining an emergency fund.

-

Healthcare Costs: Healthcare costs can be a significant expense in retirement. Research health insurance options and consider strategies for managing healthcare expenses.

-

Longevity Risk: Living longer than expected can deplete your retirement savings. Factor in longevity risk when calculating your FIRE number.

Refining Your FIRE Plan: Continuous Evaluation and Adjustment

Achieving FIRE is an ongoing process. Regularly evaluate your progress, adjust your strategy as needed, and stay informed about changes in the financial landscape.

-

Track Your Progress: Monitor your savings rate, investment performance, and progress toward your FIRE number.

-

Reassess Your Spending: Periodically review your expenses and identify areas where you can further reduce spending or optimize your budget.

-

Adjust Your Investment Strategy: Rebalance your portfolio regularly and adjust your asset allocation as needed to align with your risk tolerance and investment goals.

-

Stay Informed: Keep up-to-date on changes in tax laws, investment strategies, and the overall economic environment.

By carefully considering these strategies and continuously refining your approach, you can increase your chances of achieving FIRE and enjoying a life of financial freedom. Remember, the journey to financial independence is a marathon, not a sprint. Stay focused, disciplined, and adaptable, and you can achieve your own version of FIRE.