Staying the Course: Tips for Maintaining Motivation on Your FIRE Journey

The FIRE (Financial Independence, Retire Early) movement offers a tantalizing vision of freedom: escaping the traditional 9-to-5 grind and living life on your own terms. However, the journey to financial independence is rarely a sprint. It’s a marathon requiring dedication, discipline, and, crucially, sustained motivation. Many start strong, fueled by initial excitement, but find their resolve waning over time. This article provides actionable strategies to keep your FIRE burning bright, helping you stay motivated and achieve your financial goals.

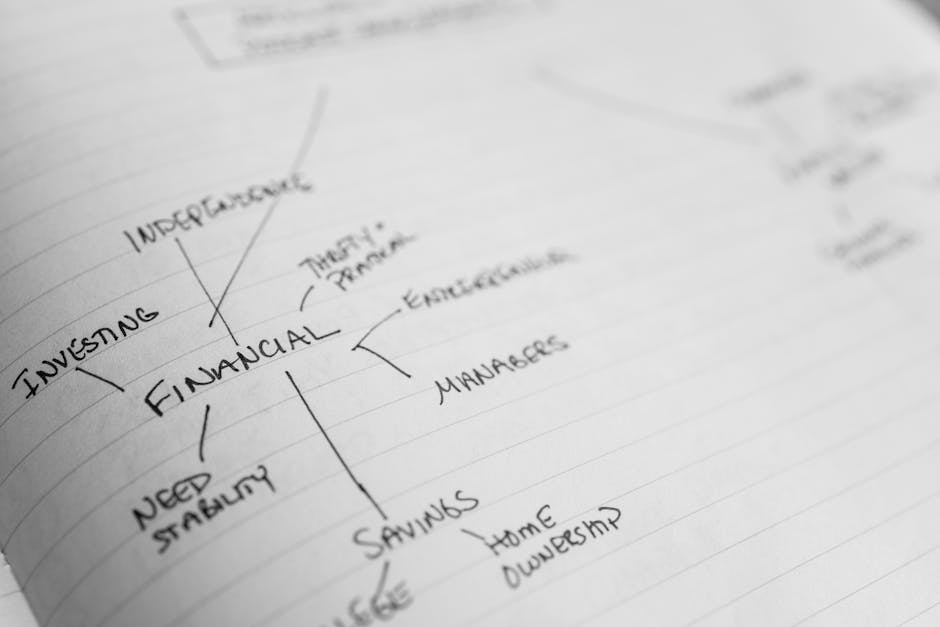

1. Define Your “Why” and Keep it Visible:

The cornerstone of sustained motivation is a crystal-clear understanding of why you’re pursuing FIRE in the first place. “Retiring early” is a vague concept; delve deeper. What will you do with your newfound freedom? Travel the world? Start a passion project? Spend more time with family? The stronger and more personally resonant your “why,” the more resilient you’ll be when faced with challenges.

- Actionable Tip: Write down your “why” in detail. Create a vision board with images representing your ideal FIRE life. Place them in prominent locations, like your workspace or refrigerator, as constant reminders of your goals. Revisit and refine your “why” periodically, ensuring it remains aligned with your evolving values and aspirations.

2. Set Realistic and Achievable Milestones:

Chasing a distant, abstract goal like “financial independence” can feel overwhelming. Break down your journey into smaller, more manageable milestones. These could be reaching a specific savings percentage, paying off a particular debt, or achieving a certain investment portfolio value.

- Actionable Tip: Use a spreadsheet or financial planning tool to map out your progress. Celebrate each milestone, no matter how small. Acknowledging your achievements reinforces positive behavior and fuels your determination to keep going. Consider sharing your milestones with a FIRE community for added accountability and encouragement.

3. Automate Your Savings and Investments:

One of the most effective ways to stay on track is to automate the process. Set up automatic transfers from your checking account to your savings and investment accounts. This removes the temptation to spend the money and ensures consistent progress toward your financial goals.

- Actionable Tip: Schedule these transfers for the beginning of each month, aligning them with your payday. Treat your savings and investments like non-negotiable expenses. Explore automated investment platforms like robo-advisors for hands-off portfolio management.

4. Optimize Your Spending and Track Your Progress:

Staying motivated requires a clear understanding of where your money is going. Meticulously track your income and expenses to identify areas where you can cut back. This doesn’t necessarily mean depriving yourself; it’s about being mindful of your spending habits and making conscious choices.

- Actionable Tip: Utilize budgeting apps or spreadsheets to track your expenses. Identify your “expense triggers” – situations or emotions that lead to impulsive spending. Develop strategies to avoid or mitigate these triggers. Review your spending habits regularly and adjust your budget accordingly.

5. Find a FIRE Community and Support System:

Surrounding yourself with like-minded individuals can provide invaluable support and encouragement. Connect with other people on the FIRE path through online forums, social media groups, or local meetups. Share your successes and challenges, learn from their experiences, and stay motivated together.

- Actionable Tip: Actively participate in FIRE communities. Ask questions, share your insights, and offer support to others. Consider finding a mentor or accountability partner within the community. Remember, you’re not alone on this journey.

6. Experiment with Side Hustles and Income Streams:

Increasing your income can significantly accelerate your FIRE journey and boost your motivation. Explore side hustles or entrepreneurial ventures that align with your skills and interests. This not only provides extra income but also keeps you engaged and challenged.

- Actionable Tip: Identify skills you can monetize. Explore online platforms like Upwork or Fiverr for freelance opportunities. Consider starting a blog or YouTube channel related to your passions. Diversifying your income streams reduces risk and provides a sense of accomplishment.

7. Prioritize Self-Care and Avoid Burnout:

The pursuit of FIRE can be demanding, and it’s crucial to prioritize your well-being. Avoid burnout by incorporating regular self-care practices into your routine. This includes getting enough sleep, eating healthy foods, exercising regularly, and engaging in activities you enjoy.

- Actionable Tip: Schedule time for self-care activities each week. Don’t feel guilty about taking breaks or indulging in occasional treats. Remember, the FIRE journey is a marathon, not a sprint. You need to pace yourself to avoid exhaustion and maintain long-term motivation.

8. Embrace Frugality as a Mindset, Not a Sacrifice:

Frugality is often associated with deprivation, but it doesn’t have to be. Frame it as a conscious choice to spend your money on things that truly matter to you, rather than mindlessly consuming. Focus on value and quality over quantity.

- Actionable Tip: Challenge yourself to find creative ways to save money without sacrificing your quality of life. Explore free or low-cost activities in your community. Cook meals at home instead of eating out. Repair or repurpose items instead of buying new ones.

9. Track Your Net Worth and Celebrate Progress:

Regularly track your net worth to visualize your progress toward financial independence. This provides a tangible measure of your success and reinforces your commitment to the FIRE path.

- Actionable Tip: Use a spreadsheet or financial tracking app to monitor your assets and liabilities. Update your net worth calculation monthly or quarterly. Celebrate significant milestones, such as reaching a specific net worth target or achieving a certain percentage of your FIRE number.

10. Adapt and Adjust Your FIRE Plan as Needed:

Life is unpredictable, and your circumstances may change over time. Be prepared to adapt your FIRE plan to accommodate unexpected events, such as job loss, medical expenses, or changes in your personal goals. Flexibility is key to maintaining motivation and staying on track.

- Actionable Tip: Review your FIRE plan annually or whenever significant life events occur. Adjust your savings rate, investment strategy, or retirement timeline as needed. Don’t be afraid to pivot if your initial plan is no longer realistic or aligned with your evolving priorities. The FIRE journey is a dynamic process, and it’s okay to change course along the way.