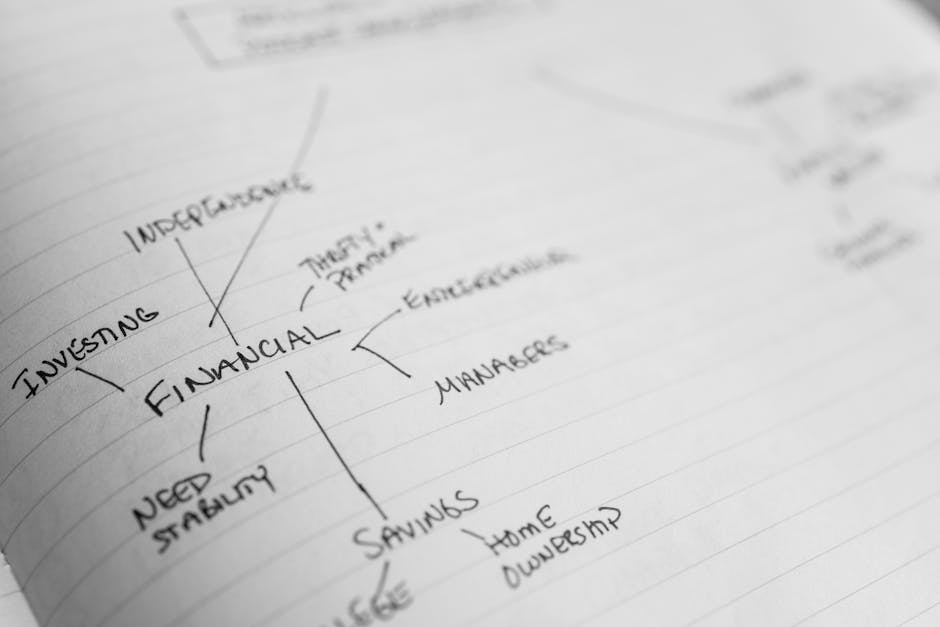

Tips for staying motivated on the FIRE path

Staying the Course: Tips for Maintaining Motivation on Your FIRE Journey The FIRE (Financial Independence, Retire Early) movement offers a tantalizing vision of freedom: escaping the traditional 9-to-5 grind and living life on your own terms. However, the journey to financial independence is rarely a sprint. It’s a marathon requiring dedication, discipline, and, crucially, sustained … Ler mais